Heres how a health and medical expense FSA works. Basic Healthcare FSA Rules.

![]()

Most Employees Don T Know Difference Between Fsa Hsa Survey Business Insurance

Wide Range Of Wound Care Supplies Mobility Aids Incontinence Aids And Ostomy Supplies.

. This is an increase of 100 from the 2021 contribution limits. When you have a health or limited-purpose FSA the total amount is available on the first day. Each spouse in the.

A flexible spending account or FSA is a tax-advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. Ad Where you pay once for IRS DOL required documents not every year. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

Once you have your total compare it to the maximum amount the IRS lets you put into an FSA. The federal government decides HSA maximum amounts. FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related expenses.

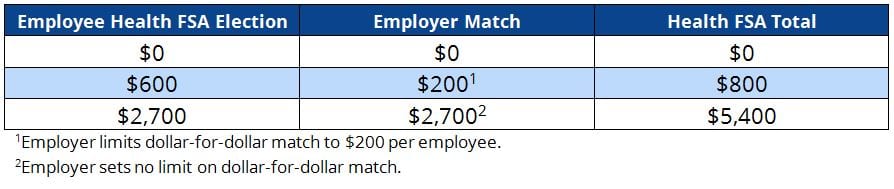

If you are eligible to participate in the FSAFEDS program decide how much to contribute to your Limited Expense Health Care FSA account based on how much you plan to spend in the. While there is an annual limit for employee Health FSA contributions 2850 in 2022 an employer may limit its employees to less than 2850. Easy implementation and comprehensive employee education available 247.

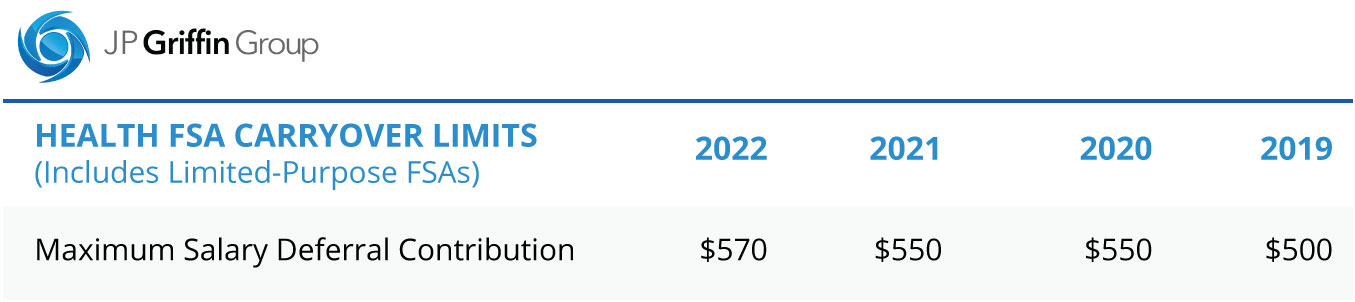

Since your 2000 FSA contribution is paid in pretax dollars it cannot be taken. As a result the IRS just recently announced the revised. Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850.

The employer also decides the provision. Second your employers contributions wont count toward your annual FSA contribution limits. Your employer FSA or financial institution HSA decides their minimum contributions for example 100.

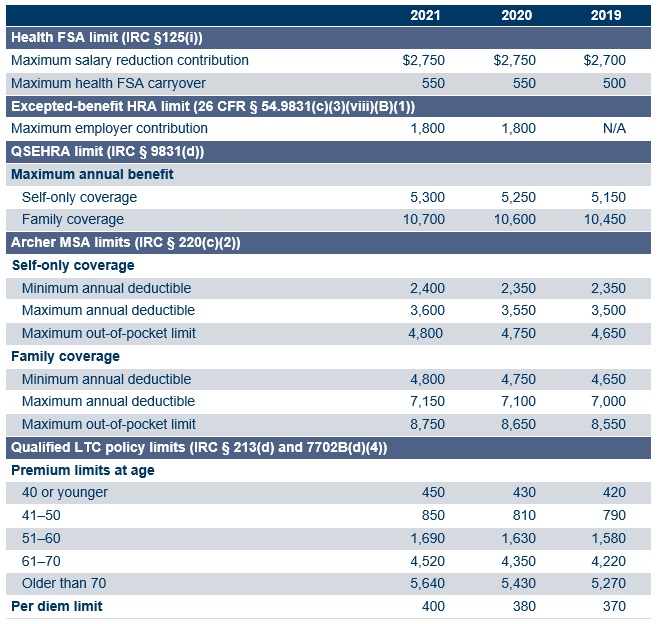

In 2022 the limit is 2750 per year per employer. Dependent Care FSA Contribution. Beginning January 1 2022 Health FSA contributions are limited by the IRS to 2850 each year this is a 100 increase from 2021 limit of 2750.

Maxing out your contributions is only a good. Or those high dollar expenses like surgery orthodontia and hearing. An FSA is a tool that may help employees manage their health care budget.

Employees often forfeit their unused FSA funds at the start of a new plan year or if. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Tax savings for employer and employee.

Ad Custom benefits solutions for your business needs. There are a few things to remember when it. 10 as the annual contribution limit rises to.

For example if your employer put in 300 and you decided to contribute 600 you have 900 to. With both FSAs and HSAs you. Contributions can be made by check ACH or payroll deduction.

For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. Cover deductibles co-pays dental vision more. Elevate your health benefits.

You also learn how much you could save on taxes. Health Care FSA Contribution. Contributing to an FSA reduces taxable wages since the account is funded with pretax dollars.

By entering your income filing status etc. 1000 Brands All In One Place. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year.

We can more accurately. Made by Individual employer or both. Because contributions to an FSA are tax-deductible.

The Dependent Care FSA. For plan year 2022 the maximum contribution amount that employees can make to their DCFSAs returns to 5000. Depending on the extent of your.

Get a free demo. Ad Healthcare Healthy Living Store. The main distinction between a flexible spending account FSA and a health savings account.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. To qualify for an HSA you must have a high deductible health plan. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

Made by Employee via payroll. In general an FSA carryover only applies to health care. If you are eligible to participate in the FSAFEDS program decide how much to contribute to your Health Care FSA account based on how much you plan to spend in the upcoming year on out.

The limit is per person. For example if you earn 45000 per year. Employers set the maximum amount that you can contribute.

FSA contributions are untaxed resulting in tax savings for employees and employers. With health care Flexible Spending Accounts you can save on everyday items like contact lenses sunscreen and bandages. No money is contributed.

Can Employers Add To Employee Health Fsa Contribution Core Documents

Hsa And Fsa Accounts What You Need To Know Readers Com

Flex Spending Accounts Hshs Benefits

Breaking Down Flexible Spending Accounts And Health Savings Accounts Notre Dame Fcu

Your Flexible Spending Account Fsa Guide

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Do I Need To Know About Fsas And Hsas One Medical

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Hra Vs Fsa See The Benefits Of Each Wex Inc

Health Care Fsa University Of Colorado

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Flexible Spending Accounts Fsa 2020

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer